All LLC members have to pay self-employment taxes-Social Security and Medicare taxes-directly to the IRS. This is the big one, guys!Īny income earned by an LLC is considered taxable income. The next point of difference between the two is self-employment taxes. It’s up to the business owner to decide how they want to be taxed.Īn LLC is generally a matter of state law, while an S-Corp is a matter of federal tax law. Interestingly, an LLC can be either an S-Corp or a C-Corp.

Then, the shareholders pay taxes on their personal earnings, including dividends. Getting an S-Corp tax status helps members avoid double taxation, which involves a company paying taxes on the earned profit. S Corporations are an elected method of deciding how your business will be taxed. Let’s make one thing clear: An S-Corp isn’t a business entity like an LLC-or a partnership, corporation, or sole proprietorship, for that matter. In turn, the directors elect officers (CEO, COO, CFO, etc.) whose jobs will be to handle daily business operations and report to the board. The board will be responsible for making major decisions and not the shareholders. The shareholders of an S-Corp elect the board of directors to look over corporate formalities. S Corporations have directors and officers, both of which have different functions. What’s more, when a group of managers runs the company, an LLC resembles a corporation set up as the members aren’t required to participate in the daily business decisions. Right off the bat, LLCs and S-Corps have different management structures.ĭepending on the number of members, an LLC can be a partnership or a sole proprietorship (if there’s only one member). Let’s review the differences and similarities between the LLC and S-Corp business structures. Getting this status gives owners access to the regular benefits of incorporation while enjoying a partnership’s tax exemption privileges. But, in addition to this, a business must meet several other requirements to qualify for an S Corporation status. Small business owners usually opt for the S-Corp structure because of its 100 or fewer shareholder limit. This allows income and other credits, deductions, and losses to pass directly to shareholders without owners having to pay federal corporate taxes.

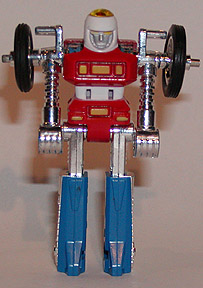

Gobot vamp vs scorp code#

Have you ever heard of a C-Corp? An S-Corp is the “light” version of it.Īn S-Corp or S Corporation is a corporation type that’s set up according to specific Internal Revenue Code requirements. Plus, as it’s very flexible and easy to manage, many entrepreneurs choose this business structure over other entities. Starting an LLC is the simplest way of structuring your business. This is known as limited liability protection. In the case of LLCs, creditors are prohibited from going after the former’s personal assets. Generally, whenever a business ends up in legal trouble or gets sued by a creditor, the plaintiff can lay a claim on the business’s and the owner’s assets. The first step is to know what we mean by the terms ‘LLC’ and ‘S-Corp.’ What’s an LLC?Īn LLC, short for Limited Liability Company, is a business structure that shields the owners’ personal assets-otherwise known as “members.”Īccording to CT Corporation, “An LLC is a hybrid entity, created to provide the liability benefits of a corporation, with the tax benefits of a partnership.” In other words, LLC members can enjoy a corporation’s limited liability feature, along with a flow-through taxation facility that’s only extended to partnerships and sole proprietorship owners. S-Corp guide, I’ll help you decide between the two by outlining the similarities, differences, and benefits. While the IRS doesn’t recognize the LLC structure, S-Corps have strict rules to ensure business compliance.Įvery business structure has its pros and cons.

LLCs are easy to set up and convenient, but S-Corps helps you save money. You want to avoid them, but first, you must decide whether to incorporate your business as an LLC or an S-Corp. Liabilities and taxes are a business reality.

Gobot vamp vs scorp software#

0 kommentar(er)

0 kommentar(er)